當年何老真係帶俾我哋上堂好多攪笑嘅回憶。

- 35th Yr Service Award Silver Plate

![]()

當年何老真係帶俾我哋上堂好多攪笑嘅回憶。

![]()

![]()

From: “Anthony Mak” <anthomak@hotmail.com>

Subject: 何佬啊!快D更新呀!

Date: Mon, 23 Sep 2002 18:16:19 +0800以下兩宗乃真人真事!一定要登出!!!

或者只登他說的最後一句…==========================

二千零一年Easter, 何佬補D.

我有D悶, 便轉身向林屴汧問: “如果你老母是x五次,咁D你老母是乜?”

佢好快答: “五既x四次.”

佢隔離的問佢講乜,佢就較大聲地覆述一次.

豈料何佬聽到,便轉身說:”做敗類都要做斯文D既….”同年, 何佬寫十條功課在黑板上.

一位叫魏炮灰(花名)的同學說: “唔係卦! 咁多!”

何佬同佢講: “(D功課)少你都唔做啦!”

??? 係唔係精警地講粗口??????==========================

可能何佬只是同我地班講過, 但我希望這兩件事人人(支持HOLOFANSCLUB的人)都知…

如果對上述事件有懷疑, 可以問沈宏基同李匡架… 睇我ICQinfo都得…麥健熙(anthomak@hotmail.com) ICQ#: 160432281

4F (2001-2002) Maths, A. Maths

5F (2002-2003) Maths, A. Maths==========================

![]()

Most often when we sell on eBay, we receive Paypal payments, so we ended up paying eBay’s commissions (also called the final value fee, FVF for short) and Paypal processing fees as a percentage of the sale.

Now eBay pushes out Managed Payments (MP) which combines payment processing fees with the eBay commissions (FVF) because eBay now manages the payment gateway. The rest is every time you sell something, you get a payout (sales – fees) deposited directly to your bank (it used to be collecting paypal balances then withdraw it).

They have a different calculation formula which they claimed the sellers are better off in most cases, but should we take eBay’s word for it? Regardless of whether you are enrolled in managed payments, the fee percentage for each sale depends on:

It’s impractical to do the side by side fee structure comparison to see when we are better off for each sale, plus we cannot easily switch between the two plans.

It’d be very helpful if we can put the managed payment fee structure on the same form as the conventional eBay+Paypal fee structure, and figure out under what conditions we are better off or worse off with managed payments.

Initially I was ready to do the derivations to put both plans on the same scale, but I spotted that managed payment (combined) percentage is simply the vanilla (non-managed) eBay category final value fee + 2.35% payment processing fees! That’s how they’ve calculated the combined managed payments percentage!

This makes life a lot easier. Since I can factor out the 2.35% that applies to the whole sum (which also include shipping and sales tax) regardless of the fee cap, this works exactly the same as Paypal (which charges 2.9%) and we are getting a 0.55% discount in payment processing fees.

For managed payments, since we’ve already separated out the payment processing fees, the fee cap applies to the vanilla final value fee portion which is equivalent to the old eBay final value fee. Keep that in mind.

The part that has changed is the fee cap. The old way caps the commissions/FVF directly regardless of product category, yet the new way (managed payments) caps the sale price that are charged commissions. This means the fee cap goes up or down a little depending on the final value fee percentage class applying to your sale.

eBay set the (commissioned) sale price cap to closely match the realized commission cap in the old way, for example non-store subscriber who will have their raw final value fees capped at $750 will see the same cap for the most common 10% categories (12.35%-2.35% = 10%) because the (commissioned) sale price cap is $7500, which $7500*10%=$750.

Big industrial equipment also have the same cap regardless because $15,000*2% = $300.

For non-store subscribers, 10% is the anchor (iso-fee-cap) category. So you are a little worse of with books (price cap +2%) and better off with musical instruments (price cap -6.5%).

For store subscribers, you get a bit more break over the fee-cap (lower) because your final value fee percentage is lower than the anchor (likely they chose a breakeven point at 10% when determining the sales price to cap final value fee over. Just easy numbers, not rocket science):

| Managed | Conventional | Discount* | |

| Common (9.15%) | $2,500*9.15% = $228.75 | $350 (Small stores) $250 (Big stores) |

$121.25 (Small stores) $21.25 (Big stores) |

| Heavy gears (1.5%) | $15,000*1.5% = $225 | $250 | $25 |

| Books (12%) | $2,500*12% = $300 | $350 (Small stores) $250 (Big stores) |

$50 (Small stores) -$50 (Big stores worse off) |

| Guitars (3.5%) | $2,500*3.5% = $87.5 | $350 (Small stores) $250 (Big stores) |

$262.5 (Small stores) $162.5 (Big stores) |

I call Basic/Premium ‘small-stores’ and Anchor/Enterprise ‘big-stores’.

So here are the observations, which is all you need to know:

So in other words,

* Remember you got 0.55% discount over the payment processing portion of the fees too and is not shown here since we’re just talking about savings in vanilla final value fees.

As far as books (12%) is concerned, if you are a big-store owner, your raw commissions cap raised from $250 to $300 because $300 = $2500 * 12%. But if you factor the 0.55% discount, if the sale price is $x,

![]()

Since the raw commissions stops at $300 ($2500 * 12%), the additional $50 cap increase starts to get offset (and turn out positive as the processing fee discounts outweighs the commissions cap increase) when the payment processing discounts ABOVE $2500 covers all of it:

![]()

So the range of sale price x which the only setup (books for big-store sellers) can do worse is

![]()

There are some ambiguities (technically incorrect documentation) on eBay’s website which implied vanilla final value fees (portion) are charged for sales tax. I made a sale and checked the numbers and it’s not true. Only the 2.35% payment processing fee portion is charged against the sales tax (like paypal for handling extra money), the category final value fee (in my case 9.15%) is not applied to the sales tax.

They actually meant “the 2.35% payment processing fee portion” when they said “managed payment final value fees”. This is also part of the reason why I wrote this article, because they do not use the language that conceptually separate the two portion of the combined final value fees (vanilla final value fee + payment processing fee) in managed payments, thinking that they are simplifying the math for sellers, without realizing if the two concepts really fused into one, they’ll be shortchanging sellers over sales tax.

The $0.3 fixed per-transaction fee applies to both managed payments and the conventional way (Paypal also charge +$0.3 fixed per-transaction), so nothing has changed.

![]()

It’s very common to have a percentage fee (called tax rate below) slapped on our earnings:

Many adults cannot directly figure out how much EXTRA do they need to earn to get the target amount of that are rightfully theirs (after fees).

They are missing out these handy intuitions:

All you need is grade school math to figure it out, but the results are highly non-linear and are not easy to remember. This means the tutorial below makes an excellent discussion material to motivate mathematics education in grade school!

If you want to copy or use the materials, just remember to reference “Rambling Nerd with a Plan” blog page or “Humgar LLC”. You don’t have to ask and you are welcome. I certainly appreciate comments about this tutorial.

Before I start, hints for working with percentages:

Assigning intuitive names are very important for interpreting algebraic expressions with familiar life concepts!

Let’s define these variables first:

These derived variables will be discussed in the body of the tutorial

![]()

![]()

![]()

If somebody pays you the total damage ![]() before tax/fees (at rate

before tax/fees (at rate ![]() ), you are home free with

), you are home free with ![]() after subtracting the fees

after subtracting the fees ![]() from

from ![]()

![]()

In other words, you the FULL damages gets shrunk by a factor ![]() which becomes the target amount

which becomes the target amount ![]() you get to keep for yourself.

you get to keep for yourself.

Don’t be scared by the algebra! It’s just the other way of saying, if your tax rate is 30%, it means you get to keep 70% of your income, because 100%-30% = 70%, so the shrinkage ![]() is

is ![]() .

.

Since you have the target price ![]() in mind and want to undo the shrinkage (multiplication) to calculate the full amount you should charge

in mind and want to undo the shrinkage (multiplication) to calculate the full amount you should charge ![]() , you divide the target price by the

, you divide the target price by the ![]() by the same factor to magnify it back:

by the same factor to magnify it back:

![]()

It is NEVER helpful to directly multiply the fee/tax percentage with the target price ![]() like what most people would intuitively do. We can think of the division above as multiplying by the reciprocal of the loss factor

like what most people would intuitively do. We can think of the division above as multiplying by the reciprocal of the loss factor ![]() or

or ![]() , which we will call

, which we will call ![]() the magnifier:

the magnifier:

![]()

An alternative view is to break the damage ![]() into target price

into target price ![]() along with excess

along with excess ![]() to bill the customers for the fees/taxes (which goes to the collector):

to bill the customers for the fees/taxes (which goes to the collector):

![]()

My preferred way to calculate the excess is simply compute ![]() first by finding calculating the magnifier

first by finding calculating the magnifier ![]() , or simply dividing the target price

, or simply dividing the target price ![]() by the shrinkage

by the shrinkage ![]()

![]()

then subtract the target price ![]() from the damage

from the damage ![]() to get the excess:

to get the excess:

![]()

which you can write it in terms of target price ![]() which you know so you don’t have to work out the total damages

which you know so you don’t have to work out the total damages ![]() first:

first:

![]()

We can define compensation (multiplier) ![]() as how much you should multiply the target price

as how much you should multiply the target price ![]() with:

with:

![]()

to recover your fee/tax costs ![]() :

:

![]()

e.g. if you need to charge the customer 1.43 times to breakeven after fees (given a 30% tax/fees rate), the overhead ‘item’ on the bill should be 0.43 (43%) of the target price. For a $100 item, you’ll need to bill your customer $43 more just to cover a 30% fees.

In summary, we have

![]()

with ![]() that can be figured out quickly as

that can be figured out quickly as

![]()

where ![]() and

and ![]() are both bounded between 0 and 1 which adds up to 1:

are both bounded between 0 and 1 which adds up to 1:

![]()

Take an example of 30% tax rate (![]() ), the shrink is 70% (

), the shrink is 70% (![]() ), because the factors are complements to each other which adds up to 1.

), because the factors are complements to each other which adds up to 1.

![]()

If you want to write it all in terms of shrinkage ![]() :

:

![]()

Since ![]() , we can rewrite the compensation (factor) in these complement terms

, we can rewrite the compensation (factor) in these complement terms ![]() , which I think it’s the easiest way to remember:

, which I think it’s the easiest way to remember:

![]()

or simply the rate ![]() divided by shrinkage

divided by shrinkage ![]() ,

,

You can also write it in terms of fees/tax rate ![]() in full:

in full:

![]()

e.g. if you have a 30% tax rate , you can find the compensation (factor) ![]() by calculating

by calculating ![]() , because it’s simply 30% over 70%.

, because it’s simply 30% over 70%.

To estimate the overhead charge to offset the fee percentage, or compensation ![]() by multiplying with the target price

by multiplying with the target price ![]() :

:

| WRONG way |

|

| CORRECT way |

|

The gap (amount you get shortchanged by computing compensation ![]() wrong) is:

wrong) is:

![]()

The numbers look close enough (for the intuitive but wrong way) when it’s like around 10%, but your loss (overheads not charged) shoots up (non-linearly) as the fee/tax percentage goes up beyond 10%!

| Fee percentage

|

Correct overhead % to charge

|

Undercharged

|

| 5% | 5.26% | 0.26% |

| 10% | 11.11% | 1.1% |

| 20% | 25% | 5% |

| 30% | 42.86% | 12.86% |

| 40% | 66.67% | 26.67% |

| 50% | 100% | 50% |

Intuitively, you need to charge DOUBLE the target price if half of it gets taxed to breakeven, NOT adding half of the target price as the overhead! The FULL target price itself is the right overhead to charge for a 50% tax rate!

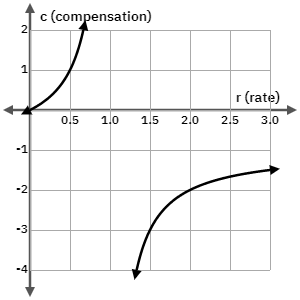

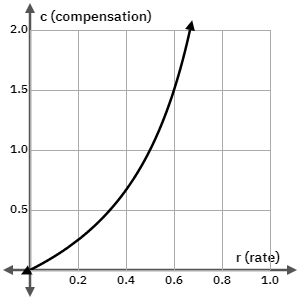

Since the numerator ![]() is bounded because

is bounded because ![]() , the denominator

, the denominator ![]() can blow up (the overhead needed to charge your customer) as it gets small (i.e. high tax/fee percentage). Here’s a plot of

can blow up (the overhead needed to charge your customer) as it gets small (i.e. high tax/fee percentage). Here’s a plot of

![]()

.

e.g. A 66.6% imports tax rate means giving two cars to the government when you import one!

To push it to the extreme, 90% tax rate would mean 900% overhead, which means if you buy one car, you give the government 9 cars, assuming they don’t tax themselves. Your estimates are off by 10 times if you use the wrong method to compute the excess ![]() making up for the tax that gets charged.

making up for the tax that gets charged.

If people can think in terms of the excess you will need to earn EXTRA to offset the tax rate, you will think twice about letting the government dip in another 2% or so. That’s why welfare-state through taxes can be highly counter-productive when it get past certain point.

Advanced analysis for the intrigued

Just for fun, let’s investigate the impractical case (communist tyrants) when tax rates gets to 100% and above (![]() ):

):

| Fee percentage

|

Correct overhead % to charge

|

Undercharged

|

| 90% | 900% | 810% |

| 100% | ||

| 200% | -200% | -400% |

| 300% | -150% | -450% |

| -100% |

– |

When charged 100% tax rate, the government seize any gains from your production. There’s never enough overhead you can charge your customer to breakeven.

The more perverted case is what happens when you go above 100%, say at 200% tax rate? When you sell $100 worth of stuff, you pay the government $200 to do so. You are paying a $100 penalty to work/produce $100 for the government. Twisted!

Then how do we explain the negative numbers in the compensation (factor) ![]() ? In reality, it means you ALWAYS make a loss no matter what. There’s no way you can bill your customer to make up for the loss.

? In reality, it means you ALWAYS make a loss no matter what. There’s no way you can bill your customer to make up for the loss.

In the unrealistic (unicorn) case, if the benevolent crazy dictator is willing and able to compensate your losses (at the sales tax rate), aka giving you money back every time you lose money,

![]()

means the the magnifier ![]() for sure when

for sure when ![]() . It’s illustrated in the graph as a deadzone

. It’s illustrated in the graph as a deadzone

![]()

:

which you can verify the same by solving this inequality

which you can verify the same by solving this inequality

![]()

and realize you get ![]() when

when ![]() , which boils down to saying

, which boils down to saying ![]() which is a contradiction.

which is a contradiction.

That means to achieve target earnings ![]() under tax rates above 100%, you should charge the customer negative amounts (i.e. giving away goods + money) in order to get the negative taxes (subsidy).

under tax rates above 100%, you should charge the customer negative amounts (i.e. giving away goods + money) in order to get the negative taxes (subsidy).

e.g. At 300% tax rate (![]() ), it your sticker price (also target price) is $100, you’ll need to GIVE the customer $50 so the government will triple match your loss as a subsidy (which is $150), which is enough to cover the $50 giveaway (to the customer) plus the $100 so you’ll breakeven.

), it your sticker price (also target price) is $100, you’ll need to GIVE the customer $50 so the government will triple match your loss as a subsidy (which is $150), which is enough to cover the $50 giveaway (to the customer) plus the $100 so you’ll breakeven.

Having negative tax (subsidy) is a perverse incentive. Forget about maintaining a target earning (same as the original sticker price for the goods you are selling), just lose (give away) money as fast as you can to suck up as much subsidy as you can before the system collapse.

I still fondly recall my economics 301 (intermediate microeconomics professors) James Montgomery saying that “if you can graph it, it can possibly happen” in the lecture.

Even more sophisticated math for the geeks

Remember from above, the magnification factor ![]() can be rewritten as the reciprocal of shrinkage factor

can be rewritten as the reciprocal of shrinkage factor ![]() ?

?

![]()

which reminds me of geometric series

![]()

given ![]() ? For non-perverted cases, we are considering

? For non-perverted cases, we are considering ![]() , which is well within the domain.

, which is well within the domain.

This gives an idea of approximating the compensation factor ![]() :

:

![]()

which after taking ![]() off both sides:

off both sides:

![]()

This explains exactly why people are wrong to just assume ![]() is just

is just ![]() , because their false intuition kept ONLY the first order term in the power series approximation!

, because their false intuition kept ONLY the first order term in the power series approximation!

The gap (how much they are off with the WRONG way), is

![]()

So while ![]() dies fast enough (0.01) by 2nd order term,

dies fast enough (0.01) by 2nd order term, ![]() ,

, ![]() … are still very significant up to say 6th order term which makes it off by a factor of

… are still very significant up to say 6th order term which makes it off by a factor of ![]() .

.

Yes, you are off by 1% when the tax rate is 10%, but you can be wrong by a factor of ![]() times if you just multiplied the tax rate

times if you just multiplied the tax rate ![]() with the target price

with the target price ![]() to estimate the amount of excess

to estimate the amount of excess ![]() to collect to make up for the fees!

to collect to make up for the fees!

Summary

![]()